The amount of profit you can take from your investments before being liable for Capital Gains Tax (CGT) is going down by more than half in April 2023.

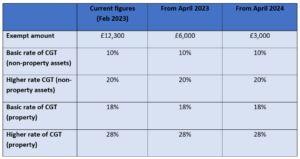

Your “annual exempt amount” is being reduced from £12,300 to £6,000 in the new tax year and will then be halved again to £3,000 in April 2024.

These changes may have a detrimental effect on your income strategy, and you could find yourself paying far more CGT on your investment profits than you’d anticipated – especially if you’re a higher- or additional-rate taxpayer.

Furthermore, it’s possible that these changes are not the end of the story, as CGT has been under review for some time. In November 2020, for instance, the then-chancellor Rishi Sunak commissioned a report from the Office for Tax Simplification (OTS), who recommended that CGT be aligned to Income Tax – the situation that existed up to 1988.

In the light of these changes, discover six simple steps you could take to help reduce your potential tax bill.

1. Remember that both you and your spouse or partner have an exempt amount

A key point when thinking about CGT is that the exempt amount applies to all individuals, regardless of earnings.

This means that sharing your assets before selling them to take advantage of two allowances can help reduce your tax bill in the 2022/23 tax year.

As of the 2022/23 tax year, you have a combined exempt amount of £24,600.

Even after April 2023, transferring assets in this way may still be worthwhile. This is because the rate at which you pay CGT is dependent on your Income Tax status. So, if your spouse pays a lower rate of Income Tax than you, they will also benefit from a lower rate of CGT.

2. Plan for the April 2023 deadline if you can

The hard deadline of the end of the 2022/23 tax year means you need to act promptly if you feel the changes to CGT could affect you.

For example, you may need to review any current plans to phase the disposal of your assets to capitalise on your current CGT allowance of £12,300 on the assumption that it would remain so in future tax years.

You should also look to maximise your exempt amount in the 2022/23 tax year if possible.

The table below sets out the 2022/23 and 2023/24 CGT rates, and the CGT rates applicable.

3. Urgently review the pending sale of any substantial assets

As you read in the introduction, your exempt amount is being reduced over the next two years. It’s also possible that CGT could align with Income Tax rates in the near future.

Clearly such changes will mean that the tax liability of selling a business property or a residential property that is not your primary address will become considerably higher.

So, it could make financial sense to review any large asset disposals you’ve been considering to see if you could benefit from bringing them forward and reducing your potential tax bill.

4. Aim to maximise your ISA allowance each year

The changes to CGT make it all the more important to try to maximise all tax-efficient means of investing.

One of the most straightforward and popular is an ISA.

Assets held in an ISA are free of CGT when you withdraw them. Each individual, regardless of their income, can contribute up to £20,000 in the 2022/23 tax year. This means that you and your spouse or partner can invest £40,000 tax-efficiently with no CGT liable when you want to draw from your ISA fund.

So, if you act quickly, you could invest a total of £80,000 – £40,000 now and £40,000 at the start of the new tax year in April – safe in the knowledge that it will be exempt from CGT.

5. Consider using bonds as an investment option

Investment bonds are often overlooked when investing. However, they can provide some valuable flexibility when it comes to your income strategy.

The tax advantages investment bonds offer have become even more valuable given the recent changes to CGT.

Investment bonds are not subject to CGT, and the ongoing taxation on withdrawals can be deferred to a future date.

This means that you can take up to 5% of your original bond investment as income each year with no immediate tax charge being payable. So, you could benefit if you’re a higher- or additional-rate taxpayer. You may be able to schedule your withdrawals in such a way that means only basic-rate tax is payable when it becomes due.

It’s also possible to mitigate the Income Tax payable by assigning segments of the bond to basic-rate or non-taxpayers.

6. Review your estate planning arrangements

Another suggested change in the OTS report was the removal of the CGT “uplift” on death.

As of the 2022/23 tax year, the uplift means that if your children inherit assets from you, the value is re-based to when they are received as part of their inheritance, and all gains accrued since you purchased the assets are disregarded.

Clearly the potential removal of the CGT uplift could mean recipients of assets through an inheritance might have to pay both CGT and Inheritance Tax (IHT).

Given this, there’s an argument for transferring assets prior to your death, or putting them in trust, to potentially help your intended beneficiary to avoid an IHT bill.

You should bear in mind that this is a complex subject. Changes will be impactful and may affect any existing plans you already have in place. We would strongly recommend you get expert advice before proceeding.

Get in touch

If you’d like to discuss the changes to CGT and how they could affect you, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production