Still have an old ISA from your early career that you haven’t looked at in years? You’re not alone.

ISAs are one of the most well-known tax shelters in the UK, offering shelter from both income tax and capital gains tax. But once you leave the UK, the rules change.

And for British expats, those changes are often misunderstood.

Whether you’re already living abroad or planning to return to the UK in the future, here’s what you need to know about how your ISA behaves internationally and how to avoid costly mistakes.

1. You can’t contribute to an ISA as a non-UK resident

Let’s start with the most common misconception: once you become a non-UK tax resident, you can’t keep topping up your ISA.

That applies across all ISA types, including:

- Cash ISAs

- Stocks and Shares ISAs

- Lifetime ISAs

- Innovative Finance ISAs

If you’ve moved abroad and your UK tax residency has ended, contributions should stop.

Important exception: Even if you move mid-tax year, but were a UK resident at the start of that year, you can still contribute up to the full £20,000 annual allowance.

2. Your ISA still grows tax-free in the UK

Do you want the good news?

Just because you’ve moved, it doesn’t mean your ISA closes. Any investments or savings already inside your ISA continue to benefit from tax-free growth within the UK tax system.

You won’t pay UK income tax on dividends or interest, and you won’t pay UK capital gains tax on profits.

That status remains intact for as long as your funds stay within the ISA wrapper.

3. But your new country may tax ISA income or gains

And here’s the catch: while the UK won’t tax your ISA growth, your new country of residence might.

Unlike pensions, which are often covered by tax treaties and offer more predictable treatment abroad, ISAs are a uniquely British product.

Many countries, including Spain, Portugal, France, and Cyprus, don’t recognise the ISA structure as tax-sheltered.

That means any income or gains could be subject to local taxation.

In some jurisdictions, ISA holdings may also count towards wealth taxes or need to be reported in local tax filings.

It’s one of the most overlooked admin headaches expats face – especially if you plan to return to the UK in the future.

That said, most Charlton House expat clients are based in Hong Kong, and the good news is that Hong Kong doesn’t tax ISA gains or income. Nor do many other typical expat hubs. So, while ISA treatment can be complex in parts of Europe, it’s less of an issue for clients in jurisdictions like Hong Kong.

Still, it pays to know where you stand. A bit of clarity now can save you a lot of confusion later – especially if your future includes a move back to the UK.

4. Thinking of returning to the UK? ISAs deserve a fresh look

If you’re planning to repatriate to the UK, whether in the next few years or later, don’t dismiss ISAs entirely.

They could form a core part of your tax planning once you re-establish residency.

Once you’re a UK tax resident again, you can:

- Resume ISA contributions, up to the annual limit (£20,000 in 2025/26).

- Withdraw tax-free for income or lump sums.

- Use ISAs strategically for IHT planning or as part of a diversified post-retirement income plan.

The key is having a clear plan for how to re-integrate ISAs into your broader financial picture, including IHT (and recent regulatory changes)..

5. ISAs and inheritance: What expats need to know

ISAs don’t escape inheritance tax (IHT) – even if you’re overseas!

For expats who remain UK domiciled (which many do, regardless of where they live), ISA holdings are still counted as part of your estate.

There’s also a reporting burden if your heirs are in different jurisdictions, especially where the tax treatment of ISAs differs.

For families with assets and beneficiaries spread across borders, this can get complicated quickly.

If passing on wealth efficiently is part of your goal, it’s worth understanding whether your current ISA holdings align with your estate planning objectives.

6. So… Should you keep your ISA or not?

There’s no one-size-fits-all answer, and it’s essential to take advice.

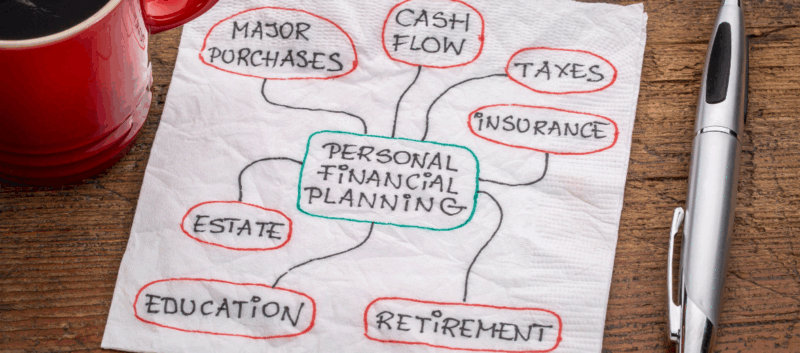

However, here are some key questions to consider:

- Will you return to the UK within the next few years?

- Do you currently live in a country that taxes ISA gains or income?

- Are you using your ISA as a retirement vehicle or a short-term savings pot?

- Is your current structure optimised for both local and UK tax rules?

- Could you be duplicating costs or increasing risk through inefficient asset location?

One thing we regularly encounter is long-term expats who haven’t reviewed their ISAs in years – sometimes holding multiple accounts, including old PEPs (predecessors to ISAs, rebranded in 1999).

These accounts often sit unmanaged across several providers. As part of a broader consolidation and simplification exercise, we help clients bring these legacy ISAs together onto a single investment platform.

That way, they can be reviewed and managed alongside offshore investments (often Jersey-based), providing a clearer, more joined-up financial picture.

In many cases, we also help clients reposition some of their investments into more tax-neutral structures while keeping ISA balances for future UK use.

However, every situation is unique, and the correct answer depends on your specific goals, timelines, and jurisdiction.

Ready to rethink your UK investments from abroad?

Whether you’ve held onto ISAs since moving overseas or you’re planning a return to the UK, your expat status plays a bigger role in your financial future than you might realise.

At Charlton House, we help British expats – especially legal professionals – untangle the cross-border complexities and create a plan that actually fits your life.

In the modern era, your financial strategy should travel as well as you do.

Let’s make sure your UK investments are still working for your life abroad – and your return home.

Get in touch and discover how seamless cross-border planning can be.

Production

Production