The nature of investment markets is that they go up and down.

You just need to look at the performance of the FTSE 100 over the last five years to see that fluctuation in value is continual, and that straightforward, consistent, linear growth doesn’t happen.

Source – Google.com

Most investors will be aware of this and prepared to take the knocks inflicted by a sudden downturn – such as the Covid impact last year – in return for an expectation of investment growth in the long term.

If your investment time frame is more than 20 years, a market crash in year three, or even year thirteen isn’t anything to be too alarmed about. History tells us that investment is best seen as a marathon, not a sprint. Markets will recover eventually, even from the most dramatic downturns.

Although the FTSE 100 is still below its pre-Covid peak, driven primarily by specific sectors that make up the UK stock markets, it took US equity markets just four months to make up the 20% loss at the start of the pandemic.

But as you get closer to retirement, market turbulence can have much more impact on your finances, and your income planning. What if a bear market coincides with when you retire, and delaying taking income is not an option?

This is known as “sequencing risk”.

The impact of sequencing risk

Sequencing risk is derived from the timing of investment performance, the impact of taking income from your fund over a period of years and, in particular, the order in which annual investment returns occur.

If you aren’t taking any income from your fund, the same investment returns in a different order will always produce the same result at the end of the term, regardless of the returns and the term.

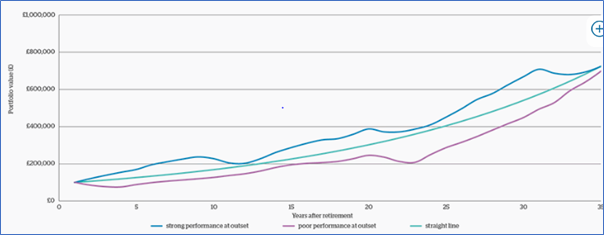

So, in the first chart, we can see the impact of three difference performance models on a fund of £100,000 over a 35 year term:

- Dark blue – strong performance at outset

- Light blue – linear performance throughout

- Purple – poor performance at outset

Source – Brooksmacdonald.com

As you can see, the funds all end up with the same value over the term and therefore have the same compound annual growth rates.

But if you’re taking regular annual income from the fund, the structure of investment funds that your investments have to work harder to recover the lost ground in the early years.

Conversely, if the value goes up before you take income, your fund is in a stronger position after taking the same income.

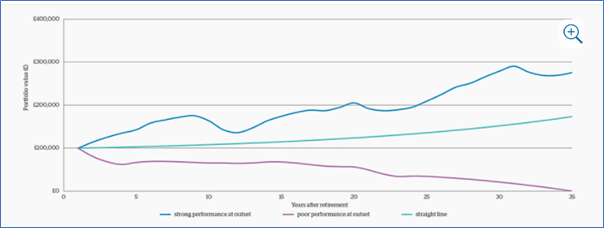

So in this second chart below, you can see the impact of taking regular, fixed, withdrawals from the fund:

This shows that when a period of poor investment performance coincides with the commencement of drawing a regular income, the investment fund never recovers and is subsequently exhausted after 35 years.

How long will your fund need to last?

Current Office for National Statistics (ONS) stats show the average man lives to age 85 and the average woman to age 87.

If you are currently looking to retire when you get to 65, that means your pension fund will need to last at least 20 years, and it’s not beyond the realms of possibility that you could have to fund 30 years of retirement as more and more people are living into their 90s.

So, it’s crucial that you manage your pension fund, and set up an effective income strategy, to guard against the impact of a period of poor investment performance as we’ve illustrated in the above examples.

Mitigating sequencing risk

There are ways of managing your investments, and how you take your income in retirement to help mitigate the potential impact of sequencing risk.

These include:

- Adjusting the amount of income you take each year to reflect investment performance

- Using other sources of income when investment values are falling

- Allocating investments in your pension fund over different time frames.

By managing your pension fund carefully, and putting together a sustainable retirement income strategy, you should be able to ensure that your pension fund lasts long enough to provide you with the desired income throughout your retirement.

Get in touch

At Charlton House, we have extensive experience in helping clients put together robust retirement income strategies to ensure they can easily weather the impact of a sudden market downturn.

Please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production