Although your pension fund is liable to form the core of your retirement income, there are other options to help you grow your wealth prior to stopping work.

Putting together a buy-to-let (BTL) property portfolio is a common way to help you fund your retirement, particularly given the rapid rise in house prices over the past 20 years.

Read about the advantages and limitations of both property and pensions as a source of retirement income.

Property has long been seen as a good option for growth

The UK property market has shown remarkable growth in the last decade, even in the light of economic uncertainty during that time.

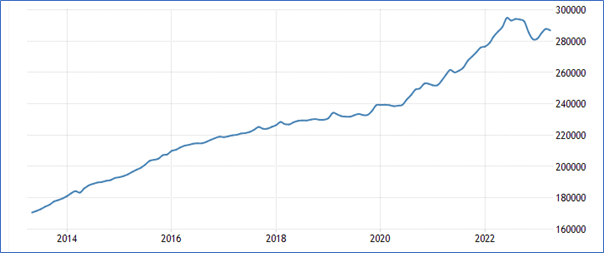

As you can see from the chart below, UK average house prices have generally risen steadily since 2013. After a recent decline, including a fall of 1.5% since February, they are still up on a year-on-year basis to March 2023.

Source: Trading Economics

Many people have, as a result, taken the chance to put together BTL property portfolios worth millions. This was fuelled by the relatively cheap cost of borrowing since 2009, although this has abruptly come to an end in the last year.

Such a step means you can benefit from a regular rental income stream, while potential increases in property values could provide you with a sizeable profit when you come to sell.

Net rental yields can vary but can still provide a decent return on top of a potentially appreciating asset.

You need to bear in mind the associated costs of BTL

Although increasing house prices have often produced a healthy return for property investors, it’s important to bear in mind that such returns can’t be guaranteed.

You also need to consider that there can be substantial costs involved with running BTL properties. These can include:

- Ongoing maintenance and repairs

- Insurance, legal, and reporting requirements

- Management charges

- The cost of any borrowing.

Because of the potential administrative burden, it can often be sensible to employ a specialist company to manage your properties, or even set up your own company. However, this can both reduce your potential profits, and increase your administration requirements.

Property is an illiquid asset

If you need to access some of the value of your portfolio for income purposes, you may find it takes some time to sell a property.

As a result of this, from a retirement income perspective, you’ll always need to plan ahead when looking to provide yourself with substantial capital sums from your portfolio. You may also find yourself in the position of needing to sell a property when you may not get the full value you might have previously anticipated.

Against that, the rent you’re receiving could provide you with a steady retirement income – provided that you consistently have tenants in the property.

Funding your retirement with the proceeds of property sales alone can be a high-risk strategy. You will need to bear in mind that local property markets can be susceptible to sudden variations and affected by local issues, such as new road building.

Also, given its illiquidity, property can’t be sold in segments to make the most of your Capital Gains Tax exemption each year, or to transfer part of the value into a tax-efficient ISA.

There are a number of taxation issues that can affect BTL property

As well as the associated ongoing administration and management costs, there are also taxation charges that could affect you as a BTL property owner and landlord.

For example, in addition to the Stamp Duty Land Tax (SDLT), payable on the purchase of any residential property, there is an additional 3% charge for residential property purchased in addition to your primary residence. On top of that, there’s a further 2% SDLT surcharge if you’re a non-UK national buying residential property in the UK.

Income you earn from BTL has to be declared on your self-assessment tax return and taxed as earned income. This means that it will be taxed at your marginal rate of Income Tax, which could be as high as 45%.

You are able to claim 20% tax credit on your mortgage interest payments, although this is not as generous as the previous system that enabled you to claim up to 45% tax relief.

Then, when you are looking to sell any of your properties, you may be liable for Capital Gains Tax (CGT) if the value of the property has risen since you purchased it.

The rate of CGT on the sale of such property is higher than on the disposal of other assets: 18% for basic-rate taxpayers, and 28% if you are a higher- or additional-rate taxpayer.

There are a number of other tax issues connected to owning UK property that have been introduced over the past 10 years or so – all of which are too involved for discussion in this article, however they include:

- An annual tax due on homes owned by companies in 2013.

- A see-through on offshore companies, typically based in the British Virgin Islands, owning UK residential property for Inheritance Tax purposes in 2017.

- The introduction of CGT on property sales for non-residents back in 2015.

As a result of these, UK residential property has become much less attractive for ownership – particularly for non-UK residents wanting to own UK residential property.

Pensions are a highly tax-efficient way to save for your retirement

Pensions are simply a way that you can invest in real companies. A pension can even invest in property, albeit not directly into UK residential property.

One benefit pensions may have over direct ownership of property is that they are remarkably tax-efficient when it comes to setting money aside to provide you with an income once you stop working.

You will benefit from basic-rate relief being automatically added to your contributions, and you can then claim higher rates of relief through your self-assessment tax return if you are eligible.

Furthermore, all investment income and gains you accrue within your pension fund are free from Income Tax and CGT.

In addition, pensions funds are not subject to Inheritance Tax. The recent removal of the Lifetime Allowance means that there is no limit on the size of fund you can tax-efficiently accrue, although you should be aware that the amount of tax-free cash you can take from your fund is capped at £268,275.

Be aware of the downsides of pension investment

In spite of the evident tax advantages, there are some downsides to investing in a pension when compared to a BTL property portfolio.

For example, pension regulations dictate that you can’t access your fund until you reach age 55 (rising to age 57 in 2028.)

There is a limit of £60,000 gross that you can tax-efficiently contribute each tax year. Furthermore, this figure falls to just £10,000 once you start to draw income from your fund.

There is also an element of risk involved with any kind of stock market investment, which means that the value of your fund could decline suddenly in the event of unexpected market volatility.

You will also need to manage your income strategy carefully to ensure you don’t run out of money in retirement.

Expert advice is essential

Before considering putting together your own BTL property portfolio and generally planning for retirement, we would strongly recommend you take expert advice, particularly if you are considering this step as a key part of your retirement income strategy.

There is always an element of risk associated with investing in a single asset class – such as property – and recent legislative changes like the reduction in your CGT annual exempt amount to just £3,000 with effect from April 2024 could make this a less attractive option.

Having said that, it is possible for a property portfolio to provide you with both regular income and long-term capital growth, and this could form an important and integral part of your wider retirement income strategy.

Ultimately, it’s a decision that should not be taken lightly.

Get in touch

If you would like to talk to us about your retirement income planning, you can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Please note

This article is for information only. Please do not act based on anything you might read in this article.

Production

Production