Even if you’ve been living overseas for some time, it’s likely that you’re keeping a close eye on UK financial matters.

This is particularly going to be the case if you still have extensive financial arrangements back in the UK.

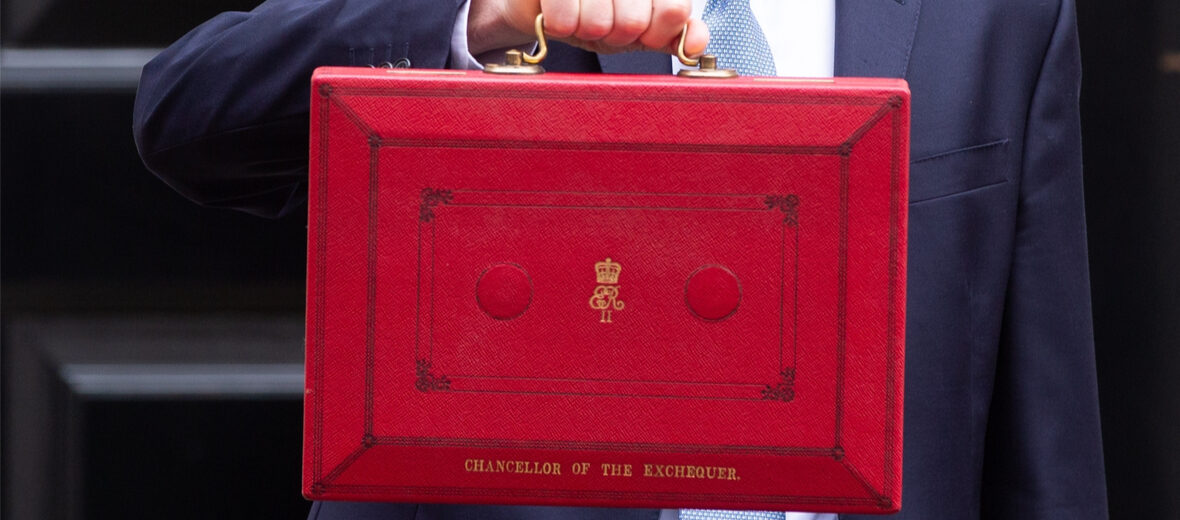

You’re probably aware of some of the headlines from the recent spring Budget, but the finer details might have escaped your notice. Or, you may not have realised the full implications of some of the announcements made by the chancellor in his speech.

Read on to discover more about the key pension-related changes announced. You’ll also find a reminder of a tax-efficient savings and investment opportunity you may well be able to take advantage of if you’re returning to the UK in the near future.

Removal of the Lifetime Allowance helps you save more tax-efficiently in your pension fund

In recent tax years, the Lifetime Allowance (LTA) has limited the amount you’ve been able to tax-efficiently save in a UK pension fund.

The chancellor was expected to increase the LTA from the 2022/23 figure of £1,073,100, but instead, he surprised everyone by announcing that it would not be applied at all in the 2023/24 tax year.

Furthermore, he also confirmed that legislation will soon be introduced to abolish the LTA entirely.

This means that, from 6 April 2023, there will be no limit on the amount of tax-efficient pension savings you can accrue.

Clearly, this is good news if you’ve been limited in the amount you’ve contributed to your UK pension arrangements through the fear of exceeding the LTA and incurring a tax charge on the excess.

But the freezing of the tax-free lump sum makes income planning more important

There was, however, a sting in the tail following the confirmation of the plans to abolish the LTA.

This was the announcement that the maximum pension commencement lump sum (PCLS) will be retained at its current level of £268,275 (25% of the current LTA of £1,073,100) and will be frozen thereafter.

This means that, regardless of the size of the fund you accrue, the maximum lump sum you can draw from it free of tax will now be limited.

This makes it all the more imperative to have an effective income strategy in place when you start drawing from your pension fund, and other sources, to ensure you’re minimising the amount of Income Tax you pay.

In a previous article, 7 steps to creating a tax-efficient income if you’re returning to the UK, we touched on some of the ways you could do this. It is well worth a read.

The changes to the Annual Allowance also mean you can save more

The chancellor also announced that the Annual Allowance will increase from £40,000 to £60,000 from 6 April 2023.

The Annual Allowance is the limit on how much money you can build up tax-free in your pension in any one tax year while still benefiting from tax relief.

So, in the 2023/24 tax year, assuming you are UK tax resident, you can contribute either £60,000 gross or 100% of your net relevant earnings, whichever is the lower amount, and benefit from tax relief.

Remember, you should automatically get basic-rate tax relief on your contributions, and you can then usually claim higher rates of relief through your self-assessment tax return.

A carry forward opportunity for returnees to the UK

The carry forward facility enables you to really give your pension fund a boost. As well as maximising your contributions in a particular tax year, you can also carry forward any unused Annual Allowance from the three previous tax years.

There’s also a handy carry forward angle if you’re an expat who has spent time offshore and you are now returning to the UK.

Once you have maximised your current year’s Annual Allowance, you can then carry forward any unused Annual Allowance from the three previous tax years enabling you make additional contributions in excess of the current year Annual Allowance. A condition for this is that you held a UK pension during any tax year in which you are carrying forward, but surprisingly this is available even if you were non-UK tax resident for that particular year!

This could be particularly useful if you’re returning to the UK to retire. It will give you the chance to top up your fund tax-efficiently prior to stopping work.

You can also save more if you’ve started drawing flexibly from your pension

As well as increasing the Annual Allowance, the chancellor also increased the Money Purchase Annual Allowance (MPAA).

The MPAA limits the amount of money you can save tax-efficiently into your pension fund after you have started drawing flexibly from your personal pension savings.

Previously, this was limited to £4,000 each year, but is being increased to £10,000 from 6 April 2023.

So, if you start taking a flexible income from your accrued pot and you are still working – maybe on a part-time or consultancy basis – you’re still able to contribute to your fund.

Get in touch

All of the changes you’ve read about in this article are designed to increase the amount you can save for your retirement while benefiting from generous rates of tax relief on your contributions.

We have a wealth of experience in helping clients plan effectively for their retirement. In a recent article, 6 practical ways we can help you with your retirement planning, we covered some of these.

To find out more, and to discuss your own arrangements, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production