Rising inflation is becoming an increasing issue for everyone, from governments and business, to individuals, right across the world.

In the UK, the Bank of England (BoE) May Monetary Report confirmed that they’re now projecting inflation to exceed 10% by the end of 2022.

In the US, inflation peaked at 8.5% in March 2022 – the highest figure for over 30 years – before falling back to 7% in April.

Compared to those figures, the Hong Kong inflation rate is still relatively low, but some essential commodities are seeing big price rises.

For example, given Hong Kong imports nearly all its food, rising food prices are a growing concern.

As you can see from the chart below showing food price inflation in Hong Kong, the escalating cost of transport and production means inflation recently hit 4.6%, its highest point in over a decade.

Source: Trading Economics

With post-pandemic travel restrictions easing, you may have also noticed a significant uptick in the cost of air travel. Checking prices recently, I saw a Cathay Pacific economy flight that would have cost as low as £500 before March 2020, is now advertised for £1,100+.

The impact of inflation on your finances

High inflation can have a very detrimental effect on the spending power of your money.

In simple terms, a rate of 10% means that goods that cost you £100 this time last year now cost £110. Unless your income is keeping track, you’re worse off from a spending point of view.

The effect of inflation can be magnified if you’re retired and living on your savings and investments. Unless your investment growth is outstripping inflation, you may well need to consider adjusting your income strategy to avoid putting too much strain on your fund.

As ever, financial markets are way ahead of the curve when it comes to reacting to the news of rising inflation. It’s worth remembering a common axiom I often repeat to clients: if you’re hearing a financial story on major news outlets, it’s already too late to do anything about it.

That’s because, in investment parlance, rising prices are already “priced in” to market values, and now markets are more concerned about a period of “stagflation” – rising inflation alongside stagnant economic demand.

The same BoE report you read about at the start of this article also suggests that unemployment is likely to rise at the end of 2022 as supply catches up with demand – and then outstrips it.

You may be tempted to change your investment strategy

In the wake of all this negative news, you may be tempted to make some changes to your investment strategy. Often the temptation will be driven by little more than the belief that you should be “doing something”.

During periods of high inflation, Warren Buffett always recommends moving into sectors and individual stocks that can pass on the cost of increased prices directly to their customers. Such companies are said to have a high pricing power. This often will include essential goods, rather than perceived luxury items.

Another investment option is to take on more risk and so potentially increase the chance of your investment growth outstripping the rate of inflation. Clearly, this will depend on your investment time frame, as increased risk goes hand-in-hand with a rise in investment volatility.

Index-linked gilts are often seen as a sensible hedge against rising inflation, however, year to date they have had a torrid time, performing more poorly than both global equities and their conventional gilts counterparts. Exposure to fixed income securities with a short duration has provided some better protection so far in 2022.

Ignore the noise

In reality, often the best thing to do is to do nothing. Remember that “do nothing” has the word “do” in it, so can be seen as a conscious move.

It’s far too easy to overreact to perceived bad news when it comes to your investment strategy. Panicking will invariably do more harm than good.

History tells us that, even after cataclysmic events, markets recover. For example, in the year after the Covid pandemic, a Guardian report revealed the FTSE 100 bounced back to finish 14.3% up after its best year since 2016.

You have a long-term strategy, so you should stick to it. Bear in mind that, if you’ve used cashflow modelling, it’s likely that your portfolio will have been stress-tested with a long-term high inflation scenario.

There’s a big positive to take away

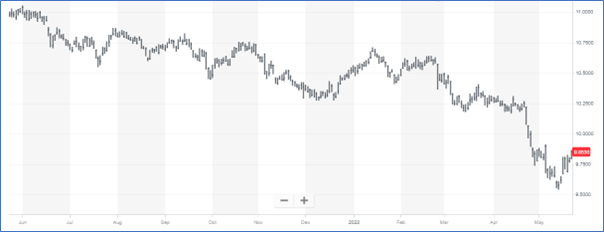

Rising UK inflation has prompted weakness for sterling against the US dollar – and so the Hong Kong dollar that’s pegged to it.

Source: Yahoo.com

The pound has declined in value against the Hong Kong dollar by as much as 15% since May 2021.

This means that you’re buying more pounds for your dollar, and so are in a strong position when it comes to paying for any expenses you’re incurring in the UK. These could potentially include things like school fees, supporting elderly relatives, or purchasing a home if you are relocating to the UK.

Every cloud has a silver lining.

Get in touch

If you’re concerned about rising inflation, and how it could affect your investment portfolio, please get in touch.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production