UK life insurance for expats: How much are you paying?

Life insurance can be expensive for internationally minded individuals and families, especially those living in Hong Kong and the wider Asia region.

If you have insurance bought through an international insurer, it’s likely that the cost – even for the simplest type of policy – is much higher than you need to pay.

You can benefit from cheaper life insurance than that offered by international insurers by arranging cover through UK-based insurers.

This is where we come in.

Here at Charlton House Wealth Management, we are ideally placed to be able to help you.

We are authorised to conduct business both in the UK and east Asia by the relevant financial regulator, enabling us to offer this type of cover.

How much could you save?

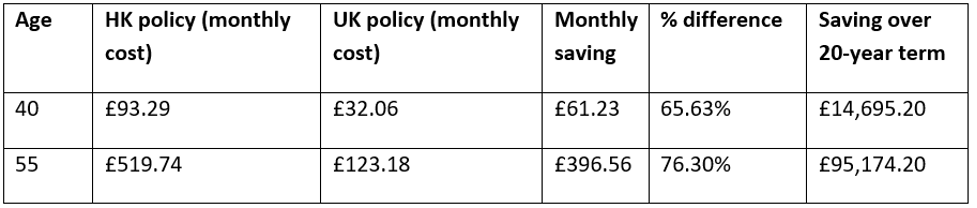

Here are some example costs of ordinary life insurance for Hong Kong residents taken out through a Hong Kong-based insurer. These figures are based on a policy providing:

- £500,000 of life cover

- For a non-smoker

- Over a term of 20 years

- Assuming no serious underlying health conditions.

We’ve compared this with the rates offered to Hong Kong residents by certain UK-based insurers. Both these examples demonstrate the substantial savings you could make.

Source – direct from reputable HK and UK insurers

Ready to start saving?

Complete the form on this page if you’d like to know more about reviewing your life insurance arrangements and the cost of cover that we could arrange for you.

We’ll be in touch as soon as possible with a bespoke, personalised quote based on the information provided.

In the meantime, if you have any questions, please don’t hesitate to get in touch with us. You can contact us by emailing info@charltonhousewm.com, or if you prefer to speak to us, you can reach us on +852 39039004.

Production

Production