How much are you paying for your life insurance?

If you are living in Hong Kong with insurance bought through a Hong Kong or international insurer, it’s likely that the cost – even for the simplest type of policy is much higher than you need to pay.

You may be interested in a cheaper option which could result in you paying significantly less for your life insurance than you may well be at present. Read on to find out how.

Hong Kong based life insurance can be expensive

Of the many financial products available, life insurance is probably the most straightforward and the most important.

In return for paying a monthly premium over a fixed term, you benefit from the peace of mind of knowing that your loved ones will be financially supported in the event of your untimely death. They can use the payout to repay a mortgage or other debts, replace lost income, and maintain their lifestyle. You can also use life insurance to protect against a potential UK Inheritance Tax liability.

However, the cost of even the simplest life insurance can be surprisingly expensive for the average internationally mobile person, particularly if you’re over 50.

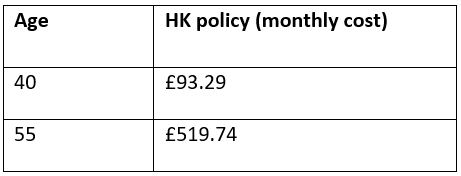

For example, here are some example costs of ordinary life insurance for Hong Kong residents taken out through a Hong Kong based insurer. These figures are based on a policy providing £500,000 of life cover for a non-smoker over a term of 20 years, assuming no serious underlying health conditions.

Source – Charlton House Wealth Management

A cheaper solution for you

It is possible for you to benefit from cheaper life insurance than that offered by Hong Kong-based insurers by arranging cover through UK-based insurers.

One stipulation is that the life cover you take out must be written to cover a UK-based liability. For example, this could be a UK mortgage or a potential Inheritance Tax liability.

To our knowledge there are only a couple of insurers currently offering this type of insurance policy. However, they will only provide cover if it is advised on, and introduced by, a UK regulated firm.

This is where we come in.

Here at Charlton House Wealth Management, we are ideally placed to be able to help you by taking advantage of our business structure. We are authorised to conduct business both in the UK and Hong Kong by the relevant financial regulator, enabling us to offer this type of cover.

The amount you could save

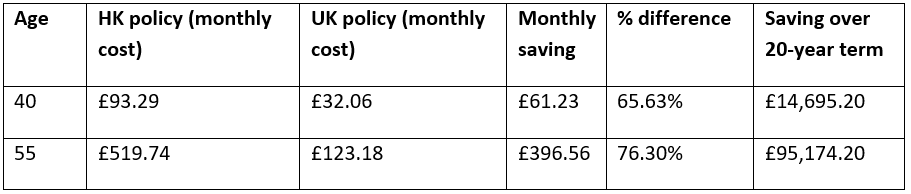

To give you an idea of what you could save, let’s take the same examples we used in the table above and compare them with the rates offered to Hong Kong residents by certain UK-based insurers.

Source – Charlton House Wealth Management

Both these examples demonstrate the substantial savings you could make.

To give you a very quick idea of what savings of this scale could mean for your financial planning, if you were to invest the £396.56 monthly saving in the second example, and it were to grow at a net annual average rate of 3%, after 20 years it would be worth £129,397.

Ideal if you have insurable assets in the UK

Obviously, this kind of cover is ideal for British individuals currently based in Hong Kong, but with plans to return home to the UK in the short or medium term. It’s also relevant for Hong Kong and other non-UK nationals with insurable assets in the UK.

3 key benefits to this cover

This kind of financial arrangement offers three key benefits:

- As you can see from the figures we’ve outlined above, you can make a substantial monthly saving on the cost of simple life insurance. This immediately frees up money that you can divert for investment elsewhere

- As the insurance is UK-based, it will save you the cost and time of rewriting it when you decide to return to the UK in the future

- You are immediately covered if the political instability in Hong Kong means you’re forced to return to the UK at short notice.

How we can help

Please get in touch with us if you’d like to know more about reviewing your life insurance arrangements., You could make considerable savings on the cost of cover.

We have extensive experience of the financial challenged faced by Hong Kong residents who are still domiciled in the UK, and are uniquely placed to offer innovative solutions which, in this case for example, could potentially save you thousands of pounds on the cost of your protection.

You can contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production