Regardless of geographical location, employer retirement savings is usually one of the top benefits that you’ll look for when you’re starting a new job.

This explains why, with offices in the UK and Hong Kong, and being regulated to provide advice in both, we’re often asked about mandatory provident funds (MPF), particularly by clients who have recently arrived from the UK to begin working in Hong Kong.

I’ve heard many a misplaced comment from people over the years saying things like “pensions are not a good investment”.

In the case of an MPF, it’s not the pension that should be assessed as to whether it’s a good investment but the actual investment options available.

As someone with plenty of experience advising clients in Hong Kong, I have a rather jaundiced view of MPFs. In this article, you can find out why that is.

MPFs are a government-mandated retirement savings scheme

First, let me quickly outline to you exactly what MPFs are.

Launched in December 2000, they are Hong Kong’s government-mandated approach to retirement savings.

They are structured savings scheme designed to provide retirement savings for employed and self-employed Hong Kong citizens.

In most cases, participation is mandatory for employers and employees. So, all multinational companies that employ citizens in Hong Kong between the ages of 18 and 64 years old are required to provide access to an MPF, unless they offer an alternative such as a scheme under the occupational retirement schemes ordinance or more commonly known as a an ORSO.

Read more here: 5 important issues to consider about Hong Kong Pension Schemes

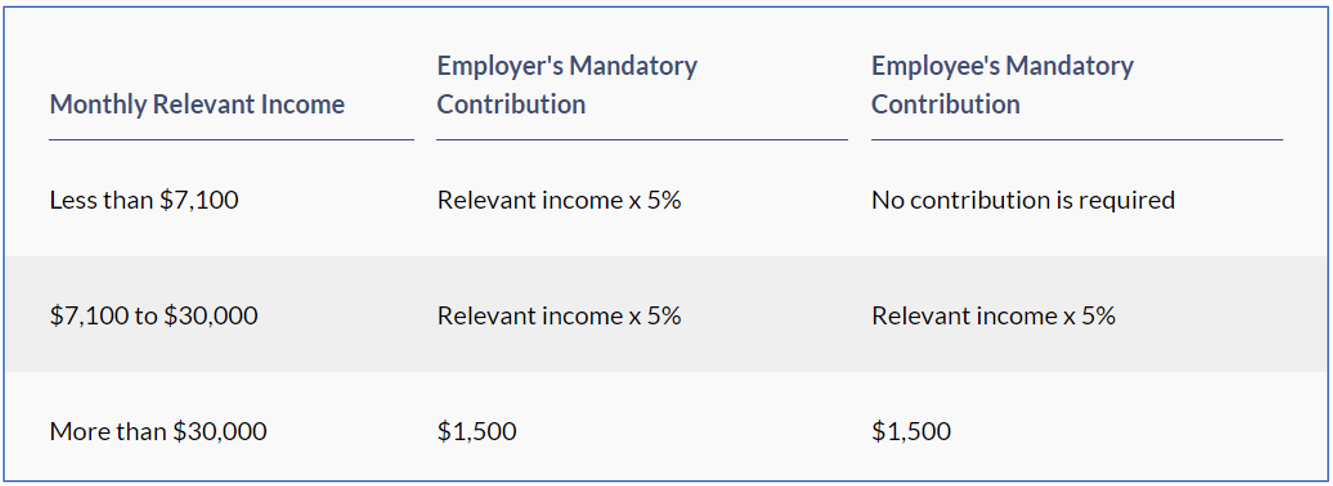

As you can see from the table below, based on an exchange rate of 10 Hong Kong dollars to the pound, contribution levels are relatively low.

Source: Mandatory provident funds schemes authority

As an employee, you can claim your mandatory MPF contributions on your annual Hong Kong tax return.

Additionally, subject to scheme rules, you have the option to make additional Tax Deductible Voluntary Contributions (TVC) of up to HKD$60,000 each year.

However, while you should absolutely take advantage of the effectively “free” money you benefit from through employer contributions and TVC tax deductions, for reasons that will become clear, we do question the idea of holding funds in an MPF any longer than you need to.

The lack of fund choice is a cause for concern

To my mind, one of the big downsides when it comes to MPF’s is the lack of funds the MPF providers offer. This is down to legislation which dictates that you are only allowed to invest in funds that the providers themselves manage.

So, from research we have carried out at Charlton House, the maximum number of funds we could find across the main MPF providers is just 29.

For comparison purposes, when we are putting together an investment portfolio for a client, we have access to over a thousand funds. To be honest, choice isn’t everything for an MPF scheme where for the majority of joiners simplicity is key and a limited number of funds can make your life easier.

But a wider fund choice, even if it’s not in the hundreds, gives you more flexibility when it comes to choosing where to invest your money.

Furthermore, if you’re limited to the funds offered by the MPF provider, you’re at their mercy when it comes to the quality of their funds and fund managers.

For example, many MPF providers promote their lower-risk funds as “guaranteed”.

I guess it’s easy to offer a guarantee if you only need to target a very low return. The problem with that approach is that a more likely scenario is that your money is also “guaranteed” to be decimated by inflation over the years.

Many also offer “target date” or “lifestyle” retirement funds. These offer an ostensibly reassuring methodology whereby your assets are gradually moved into primarily lower-risk, fixed-income funds ready for your retirement.

What that overlooks, however, is that your retirement could last for 30 years and, as a result, your low-risk investments are almost certainly to be destroyed by the ravages of inflation. In my opinion the idea of de-risking in the approach to retirement is somewhat outdated, and more relevant to the days when the average retirement lasted just 10-15 years.

Another issue around fund choice is the regional skew to Asia Pacific funds and in particular the constituents of the Hang Seng index.

I have previously written about the issue of regional bias in your investment portfolio, but in simple terms, the Hang Seng index only represents a small percentage of global stock markets by market capitalisation. As a result of this, limiting your investment choices to this one tiny market cuts out so much opportunity that is offered from the great companies of the rest of the world.

MPF fund charges and investment performance are equally problematic

Jack Bogle, the founder of Vanguard Asset Management, did so much for the asset management industry and helped line the pockets of private investors like you and me worldwide. I’m a passionate advocate of the approach Bogle preached: low cost, passive investment, and a mutual investment company returning benefit to investors through reduced charges.

Unfortunately, there are other asset management firms who have taken so much away from the industry and investors, through poor performance and high charges. Unlike the Vanguard mutual model, and the many others that have modernised their approach since, they are still offering asset management propositions that are more closely matched to the industry norms that were prevalent back in the 1970’s when Vanguard was founded!.

Sadly, MPF funds tend to be managed by the latter.

For example, one of the dominant MPF providers has achieved active fund performance that doesn’t really live up to the ethics implied by the statues of two lions stationed at the front of its HQ. The vulture type emblem of one of its UK competitors (the blue one) is more appropriate some might think.

When I last checked, over a 10-year period up to 10 November 2023, its North American Equity Fund had returned 137%. In comparison, the Vanguard equivalent exchange-traded fund (ETF) based on the S&P 500 had returned 188.23%.

That means the equity fund underperformed its benchmark by a massive 51%, or to put it another way, around a third of the 10-year performance had been lost.

The same investment provider has only relatively recently come round to the idea of passive funds. The cynic in me suggests this reticence is down to depriving its fund managers of being able to impose high annual investment charges – 1.3%, in fact– for such derisory performance as highlighted above.

Without active fund management, high charges are harder to justify, but this particular provider has done its best. For example:

- The Vanguard S&P500 ETF already mentioned has an annual investment charge of just 0.06%

- In comparison, the equivalent North American Equity tracker fund offered by an MPF provider costs 0.7%.

That means you’re paying more than 10-times the cost for exactly the same type of investment. For what?

Your MPF options if you return to the UK

Many of the conversations we have with our clients about MPFs concern the options available if or when you return to the UK.

The key point to note is that early withdrawal of funds from your MPF is only possible if you declare that you will not come back to Hong Kong to work or establish a permanent residence there.

To my mind, this is another good argument for only investing the minimum you have to into an MPF while you’re living and working in Hong Kong.

It’s possible that an MPF could be considered to be a QNUPS (qualifying non-UK pension scheme) and, as a result, outside of your estate for Inheritance Tax (IHT) purposes.

However, it would be difficult to get sufficient funds into one for any meaningful estate reduction to apply. More importantly, I’m not sure that the poor choice of investments, poor investment performance, and high charges as outlined above really make such investments either advisable or worthwhile. In fact the lost investment performance over the longer term is likely to be greater than the loss to HMRC in eventual inheritance tax.

Get in touch

If you have any queries with regard to MPFs, please contact us by email or, if you prefer to speak to us, you can reach us in the UK on +44 (0) 208 0044900 or in Hong Kong on +852 39039004.

Production

Production